We need more money to retire ... or do we?

It’s February – that means that the Pensions and Lifetime Savings Association (PLSA), has updated its Retirement Living Standards website here.

The PLSA publish the Retirement Living Standards each year to help simplify retirement planning. The PLSA want to help savers think in a practical way about the kind of lifestyle they might lead in retirement. Retirement income can come from many sources – workplace and personal pensions, your State Pension and other sources of income or savings and investments. The new State Pension is around £11,500 a year and so a couple will potentially receive £23,000 a year from the State.

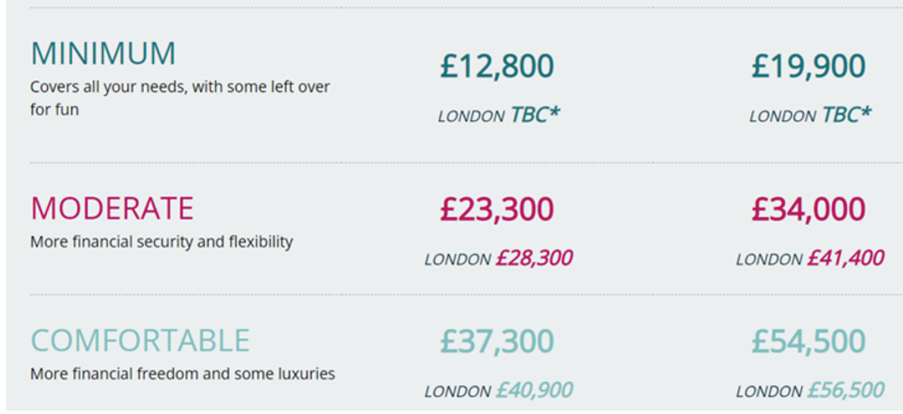

The headline numbers from 2023 for annual cost of living expenditure, for a single person and for a couple, are…

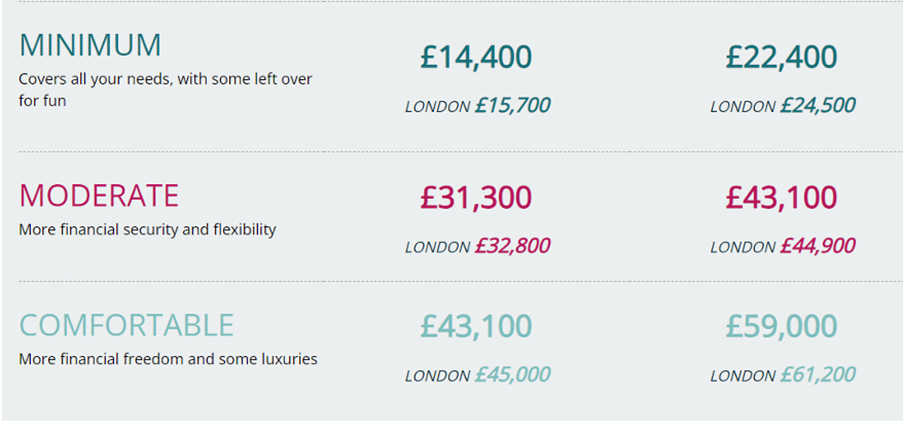

And this is what they look like in 2024 for annual cost of living expenditure for a single person and for a couple.

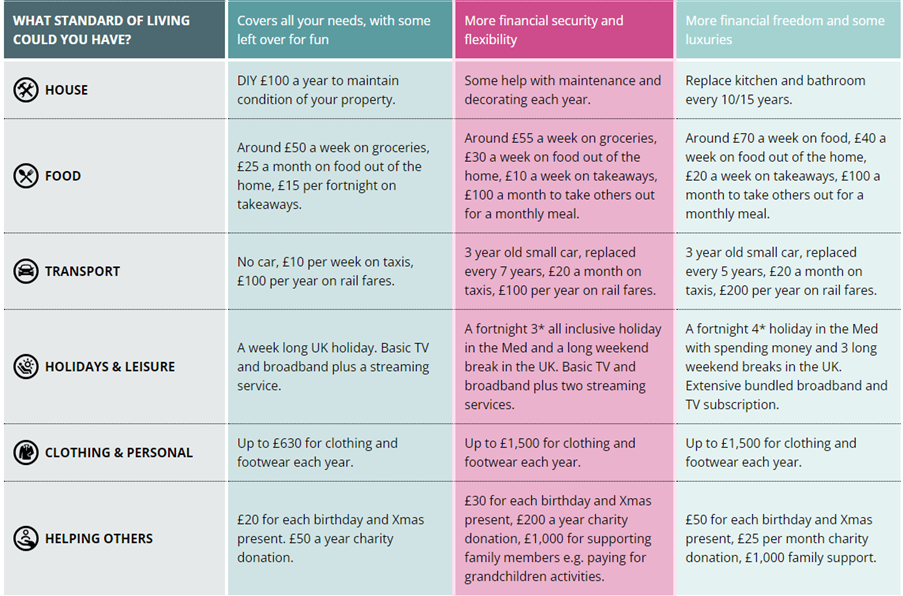

You can even get a rough idea of what that means in today’s money if you retired now with a minimum, moderate or comfortable standard of living.

The newspapers have made these changes into headlines … but it is worthwhile taking a step back to think what YOU want to spend money on in retirement. Everyone is different:

· some people will spend much more than £10 per week on takeaways but some will spend much less, and

· I personally have no intention of spending £1,500 a year on clothing and footwear!

So, think about your PERSONAL ‘to do’ list:

- Have you FOUND all your pension pots? Of course, many of you will know where all of your pension pots are. However, according to this resource, people have (on average) around £9k we have ‘lost’ (meaning the pension provider can’t track you down).

- Have you got a State Pension forecast for you (and your partner if you have one) - www.gov.uk/check-state-pension? It’s so easy to do!

- Have you done your maths right – meaning sitting with your partner and planning a budget? A tool such as www.moneyhelper.org.uk/en/ever... can help you.

- Are you maximising your employer contributions? Some plans have tiered contribution matching but enrol you at the lowest tier. Fill your boots if your budget will allow it – free money!

Remember, you may not need as much in retirement when you get there because:

- You stop paying National Insurance Contributions – this saves you 10% immediately

- You completely cut the costs of travelling to and being at work

- You hopefully will have minimised debts.

- If you use the income and taxation allowances as a couple, you could have a large amount of tax-free income in your household – over £33k per annum if you get your pension withdrawal planning right (by each drawing your personal allowance of £12,570 and the maximum tax-free cash associated with that year’s income which is £4,190 each) and

- You won’t be paying pension contributions (4% minimum).

And don’t forget that higher inflation has led to higher interest rates, which has led to higher returns on bonds and better annuity rates, which is good news if you want to buy a guaranteed for life pension when you retire. It’s not all doom and gloom!

All the best, Tim

(Tim Spriddell, Trustee Executive)